Commercial Grain Trade Q&A

This document provides a selection of questions and answers (QandA) designed to help Canadian and U.S. commercial grain-related companies with marketing and deliveries across the border.

On August 1, 2012, Canada implemented the Marketing Freedom for Grain Farmers Act. The Act changes the way Western Canadian wheat and barley farmers market their grain by removing the mandatory requirement to market wheat and barley through the Canadian Wheat Board (CWB). Since the changes brought about by the Marketing Freedom for Grain Farmers Act are important to stakeholders in the Canada – U.S. cross- border trade of grains and oilseeds, several not-for-profit associations from both the U.S. and Canada are working together to provide information to facilitate the marketing of grain between the U.S. and Canada. More information is available at: http://www.cbsa-asfc.gc.ca/publications/cn-ad/cn12-019-eng.html.

In addition to the Canadian legislation, the Canada Food Inspection Agency is developing new guidelines that will govern U.S. grain shipments into Canada and U.S. grain exports to 3rd countries that are transshipped through Canada. These questions and answers address how those changes will affect commercial trade.

We welcome your comments and additional questions. Please submit them here: https://uscanadagraintrade.org/contact/.

Important: The accuracy of the information reported and interpreted is not guaranteed. All content is subject to correction and revision. By using this website you consent to the Terms and Conditions laid out in this statement and you consent to our use and disclosure of personal information in the manner laid out in this privacy statement. If you do not agree to the Terms and Conditions or the Privacy Statement, please do not use this site.

1. Introduction

a) What updates have occurred since the Marketing Freedom Act of 2012

Deliveries of Canadian wheat and barley could be contracted and sold through the open market from any supplier and to any buyer for delivery without the single-desk Canadian Wheat Board being involved, effective August 1, 2012, export licenses were no longer be needed to export wheat, durum or barley from Canada. End-Use Certificates were ended as well. Grain entering Canada would still be subject to Canada’s phytosanitary requirements.

The USMCA changed the requirements for U.S. producers delivering wheat into Canada. Previously, US producer wheat was required to be graded as “Feed Grade”. USMCA liberalized the policy for Canadian elevators to grade the US wheat (providing it is of an approved US variety that qualifies for the Canadian wheat class) as a Canadian Grade wheat. While there are no regulatory restrictions on cross-border deliveries, beyond phytosanitary requirements, Canada does have different marketing practices and grading regulations that U.S. producers need to be aware of when delivering grain into Canada. As in any commercial transaction, U.S. producers must determine if selling into Canada is profitable.

b) How do Canadian phytosanitary requirements for U.S. grain affect U.S. exports to Canada?

Canadian Food Inspection Agency (CFIA) import directive D-12-01 outlines the general phytosanitary requirements to prevent the introduction of plants in Canada that are regulated as pests under the Plant Protection Act. Several of these pest plants are known to be associated with the grain import pathway. This directive indicates the conditions and restrictions applicable to those plants.

Commodity specific import directives also exist for corn (D-95-28), sorghum (D-96- 08); wheat, rye, barley, oats and triticale, are regulated under (D-99-01).

All CFIA’s import directives are available from the following weblink: https://inspection.canada.ca/plant-health/invasive-species/directives/date/eng/1312227346910/1312227453760

c) How are Canadian grain exports, transshipped through the U.S., treated by the U.S. regulations that govern issuance of phytosanitary certificates? And, how are U.S. grain exports, transshipped through Canada, treated by Canadian regulations that govern issuance of phytosanitary certificates?

Because of the legislation deregulating grain marketing alternatives in Canada, and since the U.S. and Canada have the ability to share logistical system capacity for export movements, movements may increasingly be transshipped cross-border before moving to a 3rd party country. Recognizing this trend, both APHIS-USDA and CFIA in Canada have endeavored to clarify specific situations in each country when re-export phytosanitary certificates may be issued; when original export phytosanitary certificates may be issued; and when neither the U.S. or Canada may be able to satisfy a company’s need to have a phytosanitary certificate issued.

Because of the complexity, and strong need for understanding by trade participants, requirements governing phytosanitary certificates of export commodities that are transshipped through a second country are detailed in Sections 7 and 8 below.

2. Finding Buyers and Sellers in Canada and the U.S.

a) How do I find buyers and sellers in Canada?

The majority of the grain and process elevators in western Canada (with the exception of feedlots and feed mills) and many grain dealers in Canada are licensed by the Canadian Grain Commission (CGC). Grain facilities that are licensed by the CGC are listed on the CGC website at: https://www.grainscanada.gc.ca/en/licences/licensed-grain-companies/

For a list of grain operations operating outside the jurisdiction of the Canada Grain Act or lawfully exempted from its provisions by the CGC, refer to the CGC website at: https://www.grainscanada.gc.ca/en/licences/unlicensed-companies.html

It should be noted that the CGC does not license primary or process elevators in eastern Canada located in Ontario, Quebec, or the Maritime provinces. Individual provincial licensing regimes exist in these areas. A list of grain handling facilities licensed in Ontario is listed on Agricorp’s website at : http://www.agricorp.com/en-ca/Programs/GFPP/Pages/CheckLicence.aspx.

Sellers of U.S. grain wishing to deliver to a Canadian grain facility are advised to contact the company prior to delivery to obtain the information necessary to conclude a commercial transaction.

Sources:

Canadian Grain Commission: https://www.grainscanada.gc.ca/en/

b) Where can I find a listing of U.S. grain elevators and buyers?

There are several locations to find contact information for U.S. grain elevators including state websites, trade association websites, private company websites, telephone directories, etc.

U.S. grain buyers are either privately owned companies or farmer-owned cooperatives.

Most states require grain buyers to be licensed and each state licensing authority maintains lists of licensed businesses. Information found through state and trade associations typically includes many aspects of interest to farmers.

Examples of state websites listing of grain buyers include:

- Idaho Department of Agriculture: https://www.agri.idaho.gov

- Michigan Department of Agriculture: https:/www.michigan.gov/mdard/

- Minnesota Department of Agriculture: https:/www.mda.state.mn.us/

- Montana Department of Agriculture: https://agr.mt.gov/

- Washington Department of Agriculture: https:/www.agr.wa.gov/

- North Dakota Department of Agriculture: https://www.nd.gov/ndda/

Relevant license requirements for grain buyers and storage providers can be found at the US Department of Agriculture, Warehouse Act website:

https://www.ams.usda.gov/rules-regulations/uswa

In the U.S., grain buyers often are members of State, Regional, or National trade associations who provide information of interest to both buyers and sellers of grain, including information on trade rules and official requirements. Examples of trade association websites you may want to visit include:

- National Grain and Feed Association: https://www.ngfa.org

- Pacific Northwest Grain and Feed Association (Idaho, Montana, Oregon and Washington): http://www.pnwgfa.org/

- Michigan: http://www.miagbiz.org/

- Minnesota: http://www.mgfa.org/

Sellers of grain that want to deliver across the border are advised to contact the company prior to delivery to ensure that company is a willing receiver/buyer of grain and the terms of a commercial transaction are fully understood.

3. Grain Grading Systems in the U.S. and Canada

a) What are the major differences and similarities in the grain grading systems in the U.S. and Canada?

The two systems are similar in that both systems establish official grades for all major grains, provide standardized measures of quality for commercial trading and facilitate price discovery and market value communication. Both grading systems allow for sales by specific factors as well as grades.

In Canada’s system U.S. origin wheat, if it is graded according to Canadian statutory grades, will be eligible for the applicable official statutory Canadian Grain Commission (CGC) grade in the particular class provided it is of a variety/varieties that is/are registered/approved by CGC for a given class of wheat. The U.S. system is not tied to any origin or variety requirements.

The two systems differ in that the official grading system in Canada encompasses a broader spectrum of specifications. As a result, there are more statutory grades in Canada versus the U.S. The U.S. system is more reliant on standard factor levels to establish base grades while allowing the contract specifications to capture customer desires that are different than those comprised within the statutory grade.

The protein measurement systems in the U.S. and Canada are different, as they are based upon different standardized moisture levels. But measurements of protein for the U.S. and Canada are comparable through mathematical conversions.

Canada relies more on statutory grades to reflect industry demand. The U.S. has fewer official grades and relies more on contract specifications to reflect industry demand. Trading on the basis of official or unofficial grades is widely available in the U.S., but exports from the U.S. must, by law, be officially graded.

Additional information on Canada and U.S. grading systems are available at:

Canada: https://www.grainscanada.gc.ca/en/grain-quality/official-grain-grading-guide/

U.S.: https://www.ams.usda.gov/grades-standards/grain-standards

b) Canadian Grain Shipped to the U.S.: Can Canadian-origin grain receive an official U.S. grade?receive an official U.S. grade?

Yes, but official inspection of Canadian grain entering the U.S. is not required. Grain, as defined by the U.S. Grain Standards Act, means corn, wheat, rye, oats, barley, flaxseed, grain sorghum, soybeans, mixed grain and any other food grains, feed grains and oilseeds for which standards are established under 7 U.S.C. Section 76. Additional information on U.S. grade standards is at:

c) Canadian Grain Shipped to the U.S.: Can Canadian-origin grain be commingled with U.S. grain at a U.S. elevator?

Yes. The commingled grain can receive an official USDA grade certificate. As a result, Canadian wheat is eligible for domestic U.S. sale and export, based on the U.S. official specifications of the grain. If Canadian grain is mixed, and loses its identity in the U.S. commercial system, it may affect its qualifications for U.S. phytosanitary certificate issuance to some countries. (See section on phytosanitary regulations.)

d) U.S. Grain Shipped to Canada: Can U.S.-origin grain receive an official Canadian grade?

Yes, but U.S. origin wheat must be of an approved variety or varieties for the class of Canadian Wheat. A US variety can be verified as approved in Canada at the following link: https://inspection.canada.ca/active/netapp/regvar/regvar_lookupe.aspx

The Canadian grain-grading system does allow U.S. wheat imports into Canada, provided that phytosanitary and other requirements are met.

In addition, Canadian grain companies and processors are free to bid for, accept delivery of and settle grain of U.S. origin based on U.S. grades and establish premiums and/or discounts for grading specifications including moisture, protein content, falling number, dockage, admixture, foreign material, damage, vomitoxin, vitreous kernels etc. in the same way grain companies and processors do in the U.S. It is important that sellers of U.S. grain into Canada discuss the various quality parameters and grading factors with the buyers in Canada prior to delivery.

e) U.S. Grain Shipped to Canada: Can U.S.-origin grain be commingled in a Canadian elevator?

Yes. Grain of U.S. and Canadian origin can be commingled. If graded according to Canadian statutory grades, the commingled grain can receive a Certificate Final (officially certified at point of export or sale) from the Canadian Grain Commission (CGC).

Mixed origin grain is also eligible for domestic sale and export sale based on U.S. grades and the specifications of the grain.

If U.S.-origin grain is mixed with Canadian, and loses its identity, it may affect its qualifications for Canadian phytosanitary certificate issuance to some countries.

f) Measuring Protein Content, are there differences in Canadian and U.S. methods?

Yes, there are some differences, as well as many similarities.

An important difference is in the reporting of test results for wheat. In Canada, protein for wheat is reported on a 13.5% moisture basis and in the U.S. protein for wheat is on a 12% moisture basis. This difference in moisture will result in U.S. protein being reported as approximately 0.2% higher than the equivalent Canadian value. In other words, in Canada a 13.5% protein on 13.5% moisture basis is equivalent to a 13.7% protein on a 12% moisture basis in the U.S.

In terms of barley, the moisture basis for protein in the U.S. and Canada is reported on a dry matter basis, as such there is no adjustment required.

Both the Canadian Grain Commission (CGC) and U.S. Federal Grain Inspection Service (FGIS) will report protein on an alternate moisture basis upon request using simple mathematical calculations to convert results.

The CGC in Canada and FGIS in the U.S. use the same reference method for analyzing the protein content of grains and oilseeds which is combustion nitrogen analysis (CNA). The CNA laboratory supports the NIRT instruments that are used for official testing in Canada and the U.S. The CNA reference method incinerates samples and captures and measures the nitrogen content. This is then converted to protein content. FGIS and CGC use CNA method AOAC 992.23, or the equivalent method AACC 46-30.

4. Contracts & Pricing

a) For grain sold in Canada, what are common contracting terms?

Grain contracts will generally contain quantity to be delivered, pricing terms, delivery period, and conveyance type—truck or rail.

In Canada a verbal agreement is considered an enforceable contract, however, in most cases a written confirmation will be forwarded to the seller to be signed and returned.

Contract prices are normally quoted on the basis of Canadian dollars per metric tonne (2204.6 pounds).

Please note that while many of the contracts used to buy and sell grain include clauses under which buyer and seller agree to comply with the U.S. and Canadian regulatory prerequisites applicable to the contract, the grain buying and selling is an environment under which grain is essentially traded with an “implied warranty of merchantability” meaning the grain being sold is subject to a warranty implied by law that goods are reasonably fit for the general purpose for which they are sold. In international sales law, merchantability forms part of the ordinary purpose of the goods. According to Article 35(2)(a) of the United Nations Convention on Contracts for the International Sale of Goods, a seller must provide goods fit for their ordinary purpose.

b) For grain sold in Canada, are there trade rules or common terms that are typically referenced?

No, there are no standardized rules for grains and oilseeds delivered to Canadian elevators. (There may, however, be some Canadian buyers that reference NGFA rules on U.S. to Canada transactions, similar to the terms in the U.S., and some of these companies may call for arbitration of disputes under NGFA rules. See question c below for more information on NGFA rules.) In most selling situations in Canada, the terms of the contract are wholly contained within the terms of the contract. Arbitration of disputes is mostly conducted through mutually agreed to arbitration or through the Canadian Federal or Provincial court system.

Sellers of U.S. grain wishing to deliver to a Canadian buyer are advised to obtain a copy of the buyer’s contract prior to entering into any commercial transaction.

c) For grain sold in the U.S., what are the common contracting terms?

Grain contracts will generally contain quantity to be delivered, pricing terms, delivery period, and conveyance type—truck or rail.

In the U.S. like Canada, a verbal agreement is considered an enforceable contract, however, in most cases a written confirmation will be forwarded to the seller to be signed.

Many grain buyers in the U.S. use the National Grain & Feed Association (NGFA) Grain Trade Rules and arbitration. Adopted in 1902, these rules govern most transactions of a financial, mercantile or commercial nature involving grain in the U.S. Increasingly, NGFA members reference the NGFA’s Trade Rules and Arbitration Rules in contracts with firms located in Mexico and Canada. In addition, Canadian and Mexican firms that become NGFA Associate/Trading members are expressly permitted to reference the NGFA’s Trade Rules and/or Arbitration Rules in their contracts, or otherwise consent to have the NGFA’s rules apply. However, before referencing the rules in cross-border trade NGFA cautions users that it is advisable to consult competent legal counsel and review international treaties that govern such transactions.

You can review these provisions and the other four sets of trade rules (barge rules, barge affreightment rules, feed rules and rail arbitration rules) promulgated by NGFA at: https://imis.ngfa.org/members/tr/Trade_Rules_Overview/ngfa/Trade_Rules/Trade_Rules_Overview.asp

Please note that while many of the contracts used to buy and sell grain include clauses under which buyer and seller agree to comply with the U.S. and Canadian regulatory prerequisites applicable to the contract, the grain buying and selling is an environment under which grain is essentially traded with an “implied warranty of merchantability” meaning the grain being sold is subject to a warranty implied by law that goods are reasonably fit for the general purpose for which they are sold. In international sales law, merchantability forms part of the ordinary purpose of the goods. According to Article 35(2)(a) of the United Nations Convention on Contracts for the International Sale of Goods, a seller must provide goods fit for their ordinary purpose.

In the United States, this obligation is in Article 2 of the Uniform Commercial Code (UCC). This warranty will apply to a merchant (that is, a person who makes an occupation of selling things) who regularly deals in the type of merchandise sold. Under U.S. law, goods are ‘merchantable’ if they meet the following conditions: The goods must conform to the standards of the trade as applicable to the contract for sale. They must be fit for the purposes such goods are ordinarily used, even if the buyer ordered them for use otherwise. They must be uniform as to quality and quantity, within tolerances of the contract for sale. They must be packed and labeled per the contract for sale. They must meet the specifications on the package labels, even if not so specified by the contract for sale.

If the merchandise is sold with an express “guarantee”, the terms of the implied warranty of merchantability will fill the gaps left by that guarantee. If the terms of the express guarantee are not specified, they will be considered to be the terms of the implied warranty of merchantability. The UCC allows sellers to disclaim the implied warranty of merchantability, provided the disclaimer is made conspicuously and the disclaimer explicitly uses the term “merchantability” in the disclaimer. Some states, however, have implemented the UCC such that this cannot be disclaimed. Prices at U.S. buyer locations are typically quoted in U.S. dollars per bushel or per ton (2,000 lb.).

5. Crossing the Border Into the U.S.

a) Where are the U.S/Canadian border crossings located?

Information regarding U.S. Customs and Border Protection offices is available at: https://www.cbp.gov/

Information regarding Canada Border Services Agency (CBSA) offices is available at https://www.cbsa-asfc.gc.ca/menu-eng.html

b) What identification is required to enter the U.S. from Canada?

Canadian producer and commercial truck drivers require a valid driver’s license for the transport unit they are operating. All drivers and passengers need a passport or Free and Secure Trade (FAST) identity card.

Canadian producer and commercial trucks arriving at the border must have Customs paperwork including a prior notification (PN) number for each shipment crossing at the border, to reference entry information that has been filed with customs in advance of arrival at the border.

All vehicles operated within the United States by motor carriers domiciled in a contiguous foreign country, shall have on board the vehicle a legible copy, in English, of an insurance document provided by an insurance company and required by the Federal Motor Carrier Safety Regulations.

Canada-domiciled motor carriers and freight forwarders must maintain, as acceptable evidence of financial responsibility, insurance policies issued by Canadian insurance companies legally authorized to issue such policies in the Canadian Province or Territory where the motor carrier or freight forwarder has its principal place of business. Proper filing and retention of MCS-90 (found here), Endorsement for Motor Carrier Policies of Insurance for Public Liability under Sections 29 and 30 of The Motor Carrier Act of 1980 MCS-90 is required.

Further information on the requirements for Canadians travelling to the U.S. is available at: https://travel.gc.ca/travelling

The U.S. Department of Transportation website: https://www.fmcsa.dot.gov/international-programs. The site is organized both by geographic area and by topic. You can click on a State or Province on a map to find information that pertains specifically to Commercial Motor Vehicle (CMV) operations for such items as general motor carrier information, licensing, oversize/overweight permitting, International Fuel Tax Agreement (IFTA) requirements, etc. You also can search by topic using the dropdown box below the map to find available information within that topic for all States and Provinces.

c) What customs and other documentation are required for grain to enter the U.S. from Canada?

Canadian trucks are allowed to deliver loads from Canada and pick up loads with a Canadian destination but generally cannot pick up U.S. loads with a U.S. destination.

The U.S. Department of Transportation website, https://www.fmcsa.dot.gov/international-programs, is organized both by geographic area and by topic. You can click on a state or province on a map to find information that pertains specifically to Commercial Motor Vehicle (CMV) operations for such items as general motor carrier information, licensing, oversize/overweight permitting, International Fuel Tax Agreement (IFTA) requirements, etc. You also can search by topic using the dropdown box below the map to find available information within that topic for all States and Provinces.

Canadian Grain Producer and Commercial Trucks would need a Standard Carrier Alpha Code (SCAC) code to transmit information electronically through the Automated Commercial Environment (ACE). https://www.cbp.gov/trade/automated

Canadian Grain Producer and Commercial Trucks arriving at the border must have customs paperwork including a prior notification (PN) number for each shipment crossing at the border, to reference entry information that has been filed with Customs in advance of arrival at the border.

d) What are the licensing and registration requirements for Canadian trucks transporting grain within the U.S.?

Canadian producer trucks hauling grains into the U.S. do not need specialized licensing (i.e., farm plates are permitted), if hauling their own grain.

The U.S. Department of Transportation website, https://www.fmcsa.dot.gov/international-programs, is organized both by geographic area and by topic. You can click on a State or Province on a map to find information that pertains specifically to Commercial Motor Vehicle (CMV) operations for such items as general motor carrier information, licensing, oversize/overweight permitting, International Fuel Tax Agreement (IFTA) requirements, etc. You also can search by topic using the dropdown box below the map to find available information within that topic for all States and Provinces.

Key items include: Canadian producer trucks must be registered under the International Fuel Tax Agreement (IFTA) and have the appropriate IFTA sticker(s) affixed to their vehicle.

The International Fuel Tax Agreement (IFTA) is an agreement between 10 provinces in Canada and 48 states in the United States of America. It makes it easier for inter-jurisdictional carriers to register, license, report and pay taxes for motor fuels (such as diesel and gasoline). Carriers pay fuel taxes to their base jurisdiction, to which they register under IRP. Those taxes are then distributed to the jurisdictions in which the vehicles traveled. More information and FAQ’s can be referenced at: https://www.iftach.org/Carriers/

Canadian producer trucks hauling grains into the U.S. must be registered with the U.S. DOT (if they are not carrying/delivering their own grain). U.S. DOT does not accept Canadian DOT registration.

The International Registration Plan (Plan) is a registration reciprocity agreement among states of the United States, the District of Columbia and provinces of Canada providing for payment of apportionable fees on the basis of total distance operated in all jurisdictions. Vehicles not registered under IRP require trip permits to travel into jurisdictions other than where they are registered. IRP’s fundamental principle is to promote and encourage the fullest possible use of the highway system. More information and FAQ’s can be found at IRP’s website: https://www.irponline.org/

Canadian producer trucks are not permitted to burn dyed gas in the U.S. – they must fill with clear diesel prior to entering into the U.S.

Producers are exempt from drug and alcohol testing as long as they are operating their own vehicle within 150 miles of their farm. (Electronic Code of Federal Regulations, Title 49: Transportation, Part 382 – Controlled Substances and Alcohol Use and Testing, S382-103 – Applicability) – presumably they are subject to testing if they exceed the maximum distance allowable (150 miles). If a producer employs farm personnel that operate their farm-plated vehicles (delivery truck) the same rules apply to the employed person as the producer.

Canadian commercial trucks must be registered and licensed in each jurisdiction they will travel through and for the weight they will be hauling. They must register through the International Registration Plan (IRP) in the base (home) jurisdiction of the vehicle.

Canadian commercial trucks are subject to Drug and Alcohol Testing through the U.S. Department of Transportation. Commercial motor carrier companies engage a certified company to conduct pre-employment drug and alcohol testing for all employed drivers. Drivers must pass the test before being permitted cross-border access. After this initial test, the drivers are subject to random testing and must pass the test to maintain their approved status.

e) What are the load restrictions for grain trucks on U.S. highways?

The U.S. has federal, state and local (county and city) restrictions and requirements for vehicles that move over roads and bridges. For example, U.S. weight limits for heavy vehicles such as grain trucks on the federal interstate highways are most often 80,000 lbs. of total weight. Emergency and seasonal weight limits are also often put in place and enforced by Federal, State and Local authorities. Some states may have higher limits that apply to state roads and highways only. Best information is most often found by contacting the appropriate authority. Contact information and details on the restrictions that apply can be found online. For instance:

- The U.S. Department of Transportation (USDOT) provides information on freight management and operations including a link to truck size and weight and bridge limit information at: https://ops.fhwa.dot.gov/freight/sw/index.htm

- The U.S. DOT also provides a website to locate the Department of Transportation by state: https://www.fhwa.dot.gov/about/webstate.cfm

- The U.S. Department of Transportation website https://www.fmcsa.dot.gov/international-programs is organized both by geographic area and by topic. You can click on a State or Province on a map to find information that pertains specifically to Commercial Motor Vehicle (CMV) operations for such items as general motor carrier information, licensing, oversize/overweight permitting, International Fuel Tax Agreement (IFTA) requirements, etc. You also can search by topic using the dropdown box below the map to find available information within that topic for all States and Provinces.

- The spreadsheet at: https://ops.fhwa.dot.gov/freight/sw/index.htm provides updated information on U.S. truck size and weight limitations.

- U.S. National Interactive Traffic and Road Closure Map: https://www.fhwa.dot.gov/trafficinfo/index.htm

- U.S. State websites that may be helpful:

- Idaho: http://511.idaho.gov

- Minnesota: http://www.511mn.org/

- Montana: http://www.mdt.mt.gov/travinfo/

- North Dakota: http://www.dot.nd.gov

- Washington: https://wsdot.wa.gov/

f) What documentation is required to import grain of Canadian origin into the U.S?

Primary responsibility for administering the U.S. laws relating to import, export and the collection of duties is given to the United States Customs and Border Protection (CBP), an agency within the Department of Homeland Security.

Information specific to importing agricultural products into the U.S. can be found at USDA’s Foreign Agricultural Service (FAS) website at https://www.fas.usda.gov/ and through the Agricultural Marketing Service (AMS) site at https://www.ams.usda.gov/.

FAS is the official U.S. Enquiry Point as required under the World Trade Organization (WTO) Agreement on the Application of Sanitary and Phytosanitary (SPS) measures for all WTO member inquiries related to SPS regulations. It is also responsible for the Food and Agricultural Import Regulations and Standards (FAIRS) report that aims to consolidate foreign import procedures for food and agricultural products. FAS provides technical information on allowable pesticide residues, food labeling and standards, sanitary and phytosanitary requirements, acceptable food additives, and certification and testing requirements of countries importing U.S. agricultural and food products.

Phytosanitary regulations are established by the importing country. Exporters must determine if the importing country requires certification that the commodity meets that country’s phytosanitary regulations; for example, freedom from a particular prohibited insect. Phytosanitary import requirements for the U.S. are determined by USDA’s Animal and Plant Health Inspection Service (APHIS). APHIS information on importing grain can be found at: https://www.aphis.usda.gov/aphis/ourfocus/planthealth/import-information

Additional information regarding importing requirements can be found in the Foreign Agriculture Service’s (FAS) Global Agriculture Information Network (GAIN) reports at https://gain.fas.usda.gov/#/home or by calling APHIS Customer Service Support office at 301.851.2046 or 877.770.5990. Subject to changes that reflect the ongoing risk assessments of APHIS, our current understanding is that wheat and barley from Canada can be imported into the U.S. without a Phytosanitary Certificate.

The U.S. Food and Drug Administration (FDA) is responsible for determining whether or not an import to the U.S. is in compliance with or in violation of the acts enforced by FDA. FDA acts under provisions of the U.S. law contained in the U.S. Federal Food, Drug and Cosmetic Act. Importers of grain are responsible for ensuring that the products are safe, sanitary, and labeled according to U.S. requirements. FDA does not approve, certify, license or otherwise sanction individual importers, products, labels or shipments. We are not aware of any current actions taken by FDA with regard to wheat or barley imported from Canada. More information on FDA actions can be found at: http://www.fda.gov/ForIndustry/ImportProgram/default.htm

Please review questions in section 6): g through k for information on crop protection chemical requirements and related matters addressed by the U.S. Environmental Protection Agency (EPA). EPA also coordinates with CBP, USDA, Food and Drug Administration (FDA), State and local authorities on actions related to biosecurity. Biosecurity is the protection of agricultural animals from any type of infectious agent — viral, bacterial, fungal, or parasitic. We are not aware of any current actions related to biosecurity with regard to wheat or barley imported from Canada. More information on U.S. biosecurity actions can be found at: https://www.epa.gov/regulatory-information-sector/agriculture-sectors-crop-naics-111-and-animal-naics-112

g) Are end-use certificates required for shipments of Canadian origin in the U.S.?

No. The requirement to submit end-use certificates for wheat was eliminated August 31, 2012.

h) What documentation is required regarding the producer’s chemical use when grain of U.S. origin is delivered to a Canadian grain facility?

No specific documents related to chemical use are required to sell grain in Canada unless specified in the contract agreement.

i) What documentation is required regarding the producer’s chemical use when grain of Canada origin is delivered to a U.S. grain facility?

No specific documents related to chemical use are required to sell grain in the U.S. unless specified in the contract agreement.

j) Where can I find information regarding chemicals approved in the U.S. but not in Canada or approved in Canada but not in the U.S.?

One good place is to register to use the Bryant Christie Inc’s BC Global Database at: https://www.bryantchristie.com/BCGlobal-Subscriptions/Pesticide-MRLs

USDA has contracted Bryant Christie to update this information to help users determine rates and limitations on the usage of agricultural pesticides. BC Global is a crop specific database that cross references pesticides by chemical brand name, method of application, rates and frequency of application, as well as pre- and post-harvest interval. The database contains information for the U.S., Mexico, and Canada, for 140 global markets, 900 Commodities, and over 1000 active ingredients.

k) Where can I find information regarding existing MRLs in the U.S. and/or Canada?

The USDA has contracted with Bryant Christie Inc to maintain a global database on pesticide MRLs. Registration is free of charge to access the current mrls at: https://www.bryantchristie.com/BCGlobal-Subscriptions/Pesticide-MRLs

Once registered, the US based company or producer user can set the filters for any destination country and select all, or specific chemicals to run a report on the mrl for that/those chemicals.

Canadian-based companies and producers can set the destination country as either the US or Canada and select all, or specific chemicals to run a report on the mrl for that/those chemicals

Additionally for Canada, mrls can be checked at the Health Canada website:

l) Where can I find current and additional information related to border crossing?

One website dedicated to making it easier for everyone who has to cross the United States / Canadian border is http://www.ezbordercrossing.com/. At the site you will find a separate page for every port along the 4000-mile border, congestion reports and a wealth of information on what is happening on the roads and border crossing points. Current border wait times, weather conditions, road conditions, traffic reports, port hours of operation, maps and contact information are some of the useful tools, and much, much more.

Canada’s Border Service Agency (www.cbsa.gc.ca) provides some current information including a webpage listing wait times: https://www.cbsa-asfc.gc.ca/bwt-taf/menu-eng.html

Many of the U.S. States and Canada Provinces have current information available on their websites. Examples include:

- Idaho: http://511.idaho.gov/

- Michigan: https://mdotjboss.state.mi.us/MiDrive/map

- Washington State: https://wsdot.wa.gov/

- Minnesota: http://www.511mn.org/

- Montana: http://www.mdt.mt.gov/travinfo/

6. Crossing the Border Into Canada

a) Where are the Canadian / U.S. border crossings located?

Information regarding Canada Border Services Agency (CBSA) offices is available at https://www.cbsa-asfc.gc.ca/menu-eng.html

Information regarding U.S. Customs and Border Protection offices is available at: https://www.cbp.gov/

b) What identification is required to enter Canada from the U.S.?

All drivers must have a valid driver’s license for the transport unit they are operating.

All drivers and passengers must have a valid passport or Free and Secure Trade (FAST) identity card.

A criminal record may require a pardon/waiver prior to gaining entry into Canada. For example, a DUI offense appears on a criminal record and could present problems when crossing the border

Further information on the requirements for Americans travelling to Canada is available at : https://www.cbsa-asfc.gc.ca/services/covid/menu-eng.html

c) What customs and other documentation is required for grain to enter Canada from the U.S.?

All carriers (Producer and Commercial) require a Canada Border Services Agency (CBSA) issued carrier code to cross the border. U.S. Trucks arriving at the border must have Customs paperwork including Pre-Arrival Review System (PARS) bar-code stickers, to reference entry information that has been filed with Customs in advance of arrival at the border.

Effective November 2012, it became mandatory for customs entries to be filed electronically a minimum of one hour in advance of the shipment arriving at the border. Shipments not filed in advance and within the minimum time allotment will not be permitted to enter into Canada.

d) What are the licensing, registration and fuel requirements for U.S. trucks transporting grain within Canada?

U.S. producers hauling grains into Canada do not require specialized licensing (i.e., farm plates are permitted), if they are hauling their own grain.

U.S. producer trucks must be registered under the International Fuel Tax Agreement (IFTA) and have the appropriate IFTA sticker(s) affixed to their vehicle (see explanation below).

U.S. producer trucks require a U.S. Department of Transportation (DOT) # only as Canada accepts U.S. DOT#s.

The National Safety Code registration is the common name used within Canada for an operating authority. For Canadian carriers, you file for this in your home province, and it follows you from the Atlantic Ocean to the Pacific coast. The province of Ontario calls this number a CVOR and Quebec calls this an NIR. To apply for your NSC number in Alberta all new carriers need to complete the Pre-Entry Program for New National Safety Code Carriers.

For US based carriers who want to operate in the Provinces of Quebec or Ontario, it is required to file for a CVOR number and NIR number as applicable.

One resource for carriers wanting to obtain operating authorities is to use a Transportation Consultant such as this one: https://www.pstc.ca/services/operating-authority-permits-and-licensing-usa-canada/operating-authorities/

U.S. producers use Ruby Red dyed diesel fuel that is tax exempt (strictly for “off road” use (i.e., farm use)). This fuel cannot be used for highway tractors for purpose of delivering grain within the U.S. and Canada. More information can be found at this Washington state website: https://www.dol.wa.gov/vehicleregistration/dyeddiesel.html, and this IRS brochure: https://www.irs.gov/pub/irs-pdf/p4941.pdf.

Some helpful information regarding Canada Fuel Regulations can be accessed at the Government of Canada’s website: https://www.canada.ca/en/environment-climate-change/services/managing-pollution/energy-production/fuel-regulations.html

U.S. Commercial Trucks must be registered and licensed in each jurisdiction they will travel through and for the weight they will be hauling. They must register through the International Registration Plan (IRP) in the base (home) jurisdiction of the vehicle.

The International Registration Plan (IRP) is a registration reciprocity agreement among states of the United States, the District of Columbia and provinces of Canada providing for payment of apportionable fees on the basis of total distance operated in all jurisdictions. Vehicles not registered under IRP require trip permits to travel into jurisdictions other than where they are registered. IRP’s fundamental principle is to promote and encourage the fullest possible use of the highway system. https://www.irponline.org/

The International Fuel Tax Agreement (IFTA) is an agreement between 10 provinces in Canada and 48 states in the United States of America. The IFTA makes it easier for inter-jurisdictional carriers to register, license, report and pay taxes for motor fuels (such as diesel and gasoline). Carriers pay fuel taxes to their base jurisdiction, to which they register under IRP. Those taxes are then distributed to the jurisdictions in which the vehicles traveled. More information and FAQ’s can be referenced at: https://www.iftach.org/Carriers/

e) What are the load restrictions for grain trucks on Canadian highways?

The Provincial and Territorial governments in Canada have authority over the weight and dimension limits which apply to the highways within their boundaries.

The Task Force on Vehicle Weights and Dimensions Policy is a national committee comprising officials from the federal, provincial, and territorial transportation departments with responsibility for pursuing greater national and/or regional uniformity of policies, regulations, and enforcement practices for heavy weight and dimension limits within Canada. The task force reports to the Council of Deputy Ministers Responsible for Transportation and Highway Safety. More information on standards and regulations, seasonal weight restrictions, and other information is available at: https://comt.ca/english/programs/trucking/Index.html.

Seasonal road restrictions are in place at certain times of the year on certain roads within the provinces particularly in the spring break-up period.

Sellers of U.S. grain wishing to deliver grain into Canada are advised to contact the provincial highways department prior to delivery to obtain the information necessary to ensure compliance with weight and dimension limits in the relevant provincial jurisdiction. More information is available at the provincial government department of highways websites:

f) What documentation is required to import grain of U.S. origin into Canada?

Depending on the crop type being imported, its origin, and its intended end use, there may be phytosanitary import requirements (i.e., a phytosanitary certificate, an import permit, certificate of origin, or other document required).

The CFIA’s import requirements are outlined in its Automated Import Reference System (AIRS) and can be found at the following link:

http://www.inspection.gc.ca/plants/imports/airs/eng/1300127512994/1300127627409

This system provides all importers and brokers with an outline of all the documents (i.e., phytosanitary certificates, import permits, certificates of origin, etc.) that may be required. AIRS is a searchable database where importers and brokers can use the Harmonized System (HS) code or the name of a commodity (common or botanical) to determine what the documentation requirements are that are specific to the origin, destination and end use of the material in Canada. The Canadian Food Inspection Agency (CFIA) is Canada’s national plant protection organization and is responsible to protect Canada’s plant resource base and issue phytosanitary certificates. The CFIA regulates the importation of any grain under the Plant Protection Act and Regulations and specific parts of the Seeds Act and Regulations.

All grain import requirements must be met prior to or at the time of importation and any shipment could be subject to inspection, sampling or testing. It is advised that persons wishing to deliver grain to a Canadian grain facility become familiar with the requirements of the CFIA regarding the importation of the particular grain into Canada.

The CFIA has developed an import primer document titled “Importing plants and plant products: what you need to know” and it provides a general overview of what is required to bring any plant product, including grain into Canada. The weblink for this document is http://www.inspection.gc.ca/plants/plant-protection/imports/primer/eng/1324568450671/1324569734910

The Automated Import Reference System (AIRS) allows and individual to search for the required documentation and entry requirements into Canada of specific products: https://airs-sari.inspection.gc.ca/airs_external/english/decisions-eng.aspx

CFIA offers an educational video on using the Automated Import Reference System (AIRS): https://inspection.canada.ca/food-safety-for-industry/video/airs-tutorial/eng/1528316420730/1528316421089

There is also an Automated Import Reference System Users guide that can be referenced at: https://airs-sari.inspection.gc.ca/AIRS_External/english/help-eng.aspx

g) What if the grain requires further processing (includes cleaning) after entering Canada?

The importer will need to ensure that any grain imported into Canada that requires further processing (such as cleaning), meets the requirements of CFIA directive D 96-07 (Import Requirements for Screenings and Grain and Seed for Cleaning):

This directive requires the importer to ensure that the facility that will be processing the grain has a compliance agreement with CFIA that outlines how the screenings generated from the further processing will be handled and disposed of.

h) Are there any additional requirements if the grain or grain products being imported into Canada are for animal feed?

All ingredients intended for use in livestock feeds must be approved. Approved livestock feed ingredients are listed in Schedules IV and V of the Feeds Regulations. The Schedules provide the approved name or names of the ingredient, as well as specifying the labeling requirements. Single ingredients listed in part I of either Schedule IV or V, may be imported without restrictions provided they meet the following criteria:

- The ingredient meets the compositional standards described in section 19 of the Feeds Regulations;

- The ingredient corresponds with the ingredient name and labeling standards described in the ingredient definition (without additional guarantees or claims);

- The labeling requirements set forth in section 26 of the Feeds Regulations are met.

Importers can demonstrate compliance of the ingredient imported by supplying the following documents at the time of importation;

- Canada Customs Invoice or Commercial Invoice; and

- Proof of exemption from feed registration.

Proof of exemption from feed registration:

The importer must reference the ingredient number in Schedule IV or V, and use the approved ingredient name on the import documentation, as a means of confirming that the ingredient is exempt from registration. The importer is responsible for ensuring that the ingredient being imported complies with the regulatory requirements described in the regulations prior to being offered for sale in the Canadian marketplace.

More information on the animal feed program can be found at: http://www.inspection.gc.ca/animals/feeds/eng/1299157225486/1320536661238

i) Are end-use certificates required for shipments of grain of U.S. origin into Canada?

No. The Marketing Freedom for Grain Farmers Act eliminated the end-use certificate requirement for U.S. grain coming into Canada. Effective August 1, 2012, U.S. grain shipments into Canada no longer required an end-use certificate.

j) Where can I find current and additional information related to border crossing?

One website dedicated to making it easier for everyone who has to cross the United States / Canadian border is https://www.ezbordercrossing.com/. At the site you will find a separate page for every port along the 4,000 mile border, congestion reports and a wealth of information on what is happening on the roads and border crossing points. Current border wait times, weather conditions, road conditions, traffic reports, port hours of operation, maps and contact information are some of the useful tools, and much, much more.

Canada’s Border Service Agency (https://www.cbsa-asfc.gc.ca/menu-eng.html) provides some current information including a webpage listing wait times: https://www.cbsa-asfc.gc.ca/bwt-taf/menu-eng.html

Many of the U.S. States and Canada Provinces have current information available on their websites. Examples include:

- Washington: https://wsdot.wa.gov/

- Idaho: https://511.idaho.gov/

- Michigan: https://mdotjboss.state.mi.us/MiDrive/map

- Minnesota: http://www.511mn.org/

- Montana: http://www.mdt.mt.gov/travinfo/

7. Canadian Export Grain Transshipped Through the U.S. to a 3rd Country: U.S. APHIS Rules Governing Phytosanitary Certificates

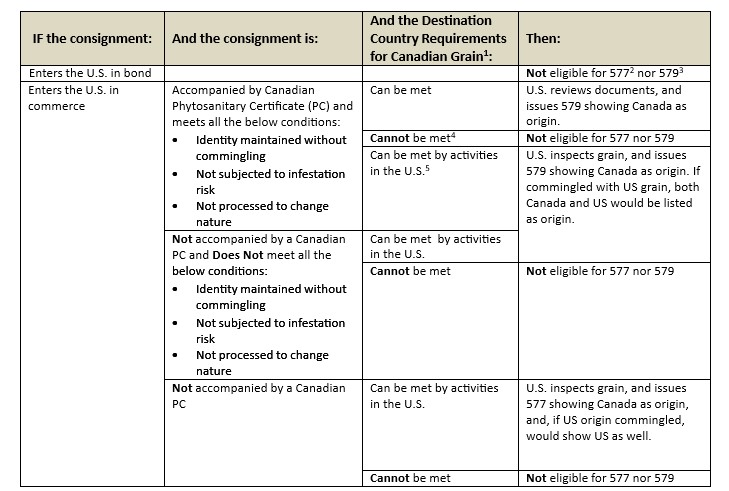

USDA’s Animal Plant Health Inspection Service (APHIS) provides services to U.S. exporters through the issuance of phytosanitary certificates that state that the commodity meets the regulations of the importing country. APHIS also provides phytosanitary certification for Canadian-origin grain making official entry into the U.S. “Official entry” means that the product was declared to U.S. border officials, with documentation showing the United States as the destination. There are three situations that could affect Canadian commodities transshipped through the U.S. that are detailed in the questions and answers below.

a) When can Canadian grain move through the U.S. without any need for

U.S. APHIS involvement for issuing a phytosanitary certificate?

There are several possible specific situations where this might occur. If the Canadian

grain enters the U.S. under bond (no possible entry into commerce and intermingling of grain with U.S.); or if the grain has been identity preserved in transit in containers without being subject to processing or infestation risk, U.S. phytosanitary certificates should not be needed, and the need for any phytosanitary certificate should be satisfied by the Canadian phytosanitary certificate originally issued. A second situation where no phytosanitary certificate would be necessary is if the importing country does not require phytosanitary certification.

b) When can US grain move through the U.S. without any need for Canadian CFIA involvement for issuing a phytosanitary certificate?

There are several possible specific situations where this might occur. If the U.S.

grain enters Canada under bond (no possible entry into commerce and intermingling of grain with U.S.); or if the grain has been identity preserved in transit in containers without being subject to processing or infestation risk, Canada phytosanitary certificates should not be needed, and the need for any phytosanitary certificate should be satisfied by the U.S. phytosanitary certificate originally issued. A second situation where no phytosanitary certificate would be necessary is if the importing country does not require phytosanitary certification.

c) Under what situations would the U.S. issue a PPQ form 579 (re-export phytosanitary certificate)?

If Canadian-produced grain enters the commerce of the U.S. with a Canadian

Phytosanitary Certificate, APHIS will issue a 579 re-export phytosanitary certificate

(without further physical inspection) if the following conditions are met: 1) the grain

originally had a Canadian phytosanitary certificate; 2) identity of grain has been

maintained; 3) the consignment has not been subject to infestation; and 4) the

commodity has not been processed to change its physical nature.

APHIS may also be able to issue a 579, even if one of these four conditions is not met, provided the grain can be demonstrated to comply with the importing country requirements.

This sometimes necessitates activities in the U.S., such as fumigation or physical

inspection of the grain. If it arises that the destination country requirements include

grain being originated from pest-free production areas as one example, APHIS

will not issue a 579 because the origination could not be demonstrated.

d) Under what situations would the U.S. issue a PPQ form 577 (U.S. Export Phytosanitary Certificate)?

If grain enters the U.S. with no original Canadian phytosanitary certificates, the

U.S. can provide an original export phytosanitary certificate. The grain would need to be inspected by APHIS. It would have to be in conformity with the importing country’s requirements for Canadian grain. Additionally the origin of the grain would have to be shown as either Canadian, or Canadian and U.S. if the grains have become intermingled.

In cases where an importing country’s requirements include commodities being grown in pest-free areas, or other requirements that cannot be confirmed by physical inspection, APHIS would not issue a 577 U.S. Export Phytosanitary Certificate.

e) If Canadian grain has been inspected and a phytosanitary issued to be re-exported from the U.S. to a specific destination, and the destination changes, can another phytosanitary be issued?

Yes. CFIA will re-examine the file sample for the new destination country, and issue a new phytosanitary certificate.

U.S. Phytosanitary Export Certification of Canadian Origin Grain

8. U.S. Export Grain Transshipped Through Canada to a 3rd Country: Canada CFIA Rules Governing Phytosanitary Certificates

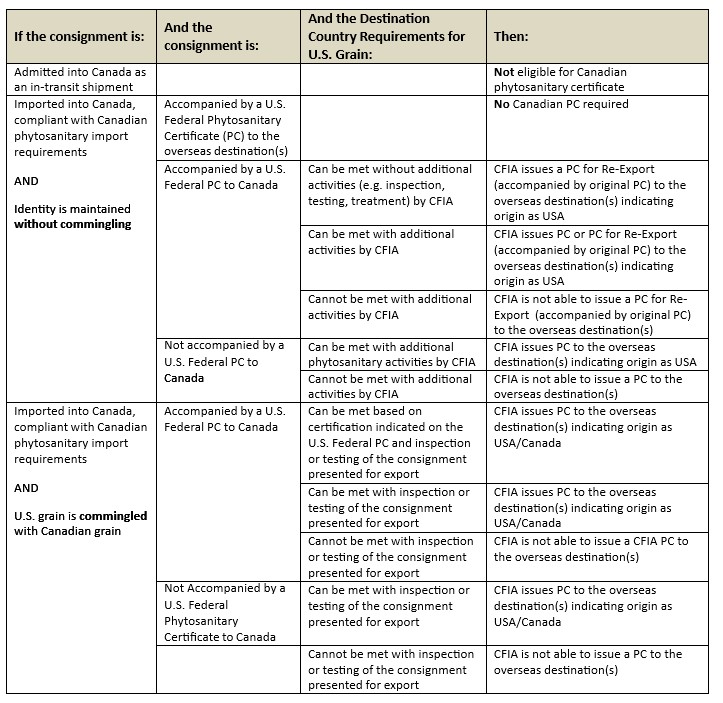

The Canada Food Inspection Agency (CFIA) provides services for U.S. grain being transshipped through Canada for export to a 3rd country in very similar ways to the services offered by USDA-APHIS for transshipped Canadian grain. The goal is to facilitate trade, provide importing country assurances that products are pest and disease free, and to stipulate the origin of products.

CFIA has provided general guidelines for issuance of transshipment certificates, but advises that its directive D-99- 06: Policy on Issuance of Phytosanitary Certificates provides additional guidance: https://inspection.canada.ca/plant-health/invasive-species/directives/exports/d-99-06/eng/1323852257037/1323852328308

a) When can U.S. grain move through Canada without any need for CFIA involvement in issuing a phytosanitary certificate?

If grain is admitted into Canada as an “in-transit” shipment, then the grain is not eligible for a Canadian phytosanitary certificate, and all the requirements of the importing country must be met by the original phytosanitary certificate (if any is required) issued by USDA-APHIS. If grain is imported into Canada with a US-APHIS phytosanitary certificate to the importing country, and identity is preserved without commingling, no Canadian phytosanitary certificate is necessary.

b) Under what situations would Canada issue a Re-Export phytosanitary certificate?

If U.S. grain is admitted into Canada as an import, accompanied with a U.S. phytosanitary certificate to Canada, CFIA can issue a Phytosanitary Certificate for Re- Export listing the origin as the USA, and the U.S. original phytosanitary certificate will be attached. In some situations, if grain comes into Canada with a U.S. phytosanitary certificate for Canada, CFIA can issue a phytosanitary certificate with additional inspection of the commodity. In some cases, the re-inspection of the commodity becomes necessary if the destination of the importing country changes. Currently APHIS would not re-examine the file sample if the destination country changes, but would require that a new sample be drawn and examined. If the grain has been comingled, and there is a different requirement for the new destination country, APHIS would not issue a new phytosanitary certificate. Canada would be unable to issue a re-export phytosanitary certificate in such case.

c) Under what situations would Canada issue a Canadian phytosanitary certificate?

If U.S. grain is admitted into Canada as an import with no U.S. issued phytosanitary certificate, CFIA will issue a Canadian phytosanitary certificate to the overseas destination, indicating origin as USA, provided CFIA is able to stipulate on the basis of its inspection that the grain is compliant with the importing country’s requirements (this may or may not be possible, depending on requirements).

In the event that U.S. grain is imported into Canada and becomes commingled with Canadian grain, CFIA can issue a phytosanitary certificate to the overseas destination indicating the origin as Canada and Foreign Mixed Grain, provided that CFIA can, through inspection or testing, verify the commodity is compliant with the importing country’s’ requirements.

a) What other information is important for grain deliveries in the U.S.?

Anyone importing into the United States may want to refer to the U.S. Customs and Border Patrol (CBP) website for general information related to importing into the United States: https://www.cbp.gov/trade and guidance from CBP on importing into and exporting from the United States can be found at: https://www.cbp.gov/trade/basic-import-export

USDA/FAS (https://www.fas.usda.gov/) is the U.S. Enquiry Point as required under the World Trade Organization (WTO) Agreement on the Application of Sanitary and Phytosanitary (SPS) measures for all WTO member inquiries related to SPS regulations. It is also responsible for the Food and Agricultural Import Regulations and Standards (FAIRS) report that aims to consolidate foreign import procedures for food and agricultural products. FAS provides technical information on allowable pesticide residues, food labeling and standards, sanitary and phytosanitary requirements, acceptable food additives, and certification and testing requirements of countries importing U.S. agricultural and food products.

On the FAS website you will find the following links to the USDA Animal Plant Health Inspection Agency (APHIS) regarding phyto-sanitary measures

- Animal and Plant Health Inspection Service:

- Import/Export Information

- Permit Services

- International Phytosanitary Standards

- Traveler’s Tips

The APHIS website is: https://www.aphis.usda.gov/aphis/home

b) What if the grain is to be re-exported from U.S.?

Once traded beyond the first point of delivery, we address the grain transaction under the Grain Commercial module on this website. For any grain that is going to be re-exported from U.S., it is the exporter and his supplier’s responsibility to ensure the commodity meets the trading, import and export requirements of the U.S. and the destination country. Commodity specific export requirements may be available by contacting the information sources listed in answer to 9a above. In most cases, once a grain shipment has been cleared by U.S. CBP, it can move within the U.S. In cases where an import permit was required, the importer is still obligated to follow all conditions set out in an import permit. More information can be found on the Commercial FAQ.

c) Once a truck with grain is in the U.S. are there any additional conditions that must followed?

Compliance with U.S. laws, including posted speed limits and other laws impacting transport in the U.S. is mandatory. Canadian trucks are allowed to deliver loads from Canada and pick up loads with a Canadian destination but generally cannot pick up U.S. loads with a U.S. destination.

Canadian Phytosanitary Export Certification of U.S. Origin Grain

Note to Exporters:

This chart is intended for general guidance only. Please contact CFIA Plant Health to determine specific phytosanitary requirements. Please see D-99-06: Policy on Issuance of Phytosanitary Certificates for additional guidance on CFIA policy.

It is important to note that it is the exporter’s responsibility to declare the origin of the grain on Application for Export Inspection and Phytosanitary Certification, Form CFIA/ACIA 3369. Origin refers to place(s) from which a consignment gains its phytosanitary status. Be prepared to present evidence to CFIA inspectors that verify information, including origin, provided on the CFIA/ACIA 3369 form.